Purpose-Built For Financial Institutions

As a Tennessee-based company, Ncontracts understands the unique challenges facing financial institutions in the Volunteer State.

We work with over 150+ financial institutions across TN, helping banks and credit unions streamline their risk and compliance operations with solutions built specifically for local regulatory requirements and regional business needs.

Learn why we've grown 130% in revenue over the last three years.

See why over 5,500 financial institutions trust Ncontracts to manage their risk and compliance. Request a demo today and we'll connect you with a specialist who understands your unique needs.

Endorsed by the Tennessee Bankers Association

Ncontracts is officially endorsed by the Tennessee Bankers Association as a trusted partner for comprehensive risk management solutions. As a Tennessee-based company, we understand the unique challenges facing local financial institutions.

Learn more →

Our Approach To Compliance Challenges

Local Expertise Meets Regulatory Excellence

Financial institutions across the state face evolving requirements from the Department of Financial Institutions alongside federal oversight.

As a company founded and headquartered here, we've developed our platform to address these specific regulatory nuances that out-of-state vendors often miss.

Our team combines deep local market knowledge with cutting-edge technology to deliver solutions that truly understand the Tennessee banking environment.

State Examination Excellence

The Department of Financial Institutions demands rigorous vendor oversight documentation and third-party risk assessment protocols.

Our locally-developed solutions simplify exam preparation by streamlining documentation and providing ready-to-submit responses that address the state's unique regulatory expectations. We know what Tennessee examiners look for because we work with them regularly.

Vendor Documentation

Tennessee requires enhanced due diligence for technology providers and financial service vendors.

Our comprehensive assessment templates and automated tracking tools ensure your institution meets Tennessee's specific documentation standards while reducing compliance workload. Built by knowledgable specialists who understand state requirements, our tools eliminate guesswork and ensure thoroughness.

Consumer Protection Compliance

The Tennessee Consumer Protection Act establishes disclosure requirements that exceed federal standards.

Navigate these complex regulations confidently with tools designed to maintain compliance with the state's unique lending requirements and documentation mandates. Our platform automatically tracks state-specific requirements, ensuring you never miss critical compliance deadlines.

Business Continuity

Regional threats including tornadoes, floods, and cyber incidents require specialized planning for Tennessee financial institutions.

Develop, test, and maintain continuity plans that satisfy state examiners while enhancing your institution's resilience against the Volunteer State's distinctive risk landscape. Our solutions address everything from severe weather protocols to regional cyber threats specific to Tennessee's financial sector.

Software Solutions Crafted for Financial Institutions

The Ncontracts risk performance management (RPM) suite is made up of

four software solutions specifically designed for the financial services industry, all of which are endorsed by the Tennessee Bankers Association.

Nrisk

The adaptive ERM platform tailored specifically for Tennessee's unique risk landscape. Designed to address the complex regulatory requirements facing financial institutions, it transforms compliance complexity into a strategic advantage.

- Identify and assess risks specific to your financial environment

- Build controls aligned with Tennessee Department of Financial Institutions expectations

- Generate specific regulatory reports with a single click

- Track emerging risks in Tennessee's dynamic banking sector

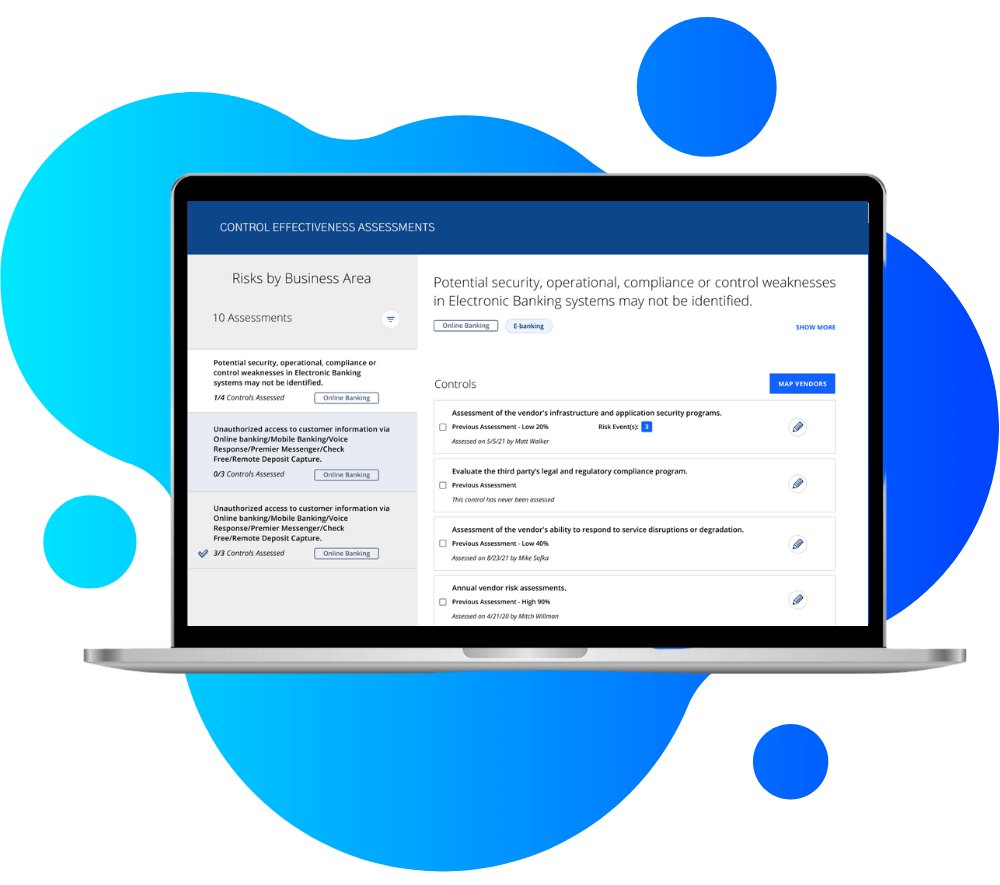

Nvendor

Financial institutions typically rely on dozens of third-party vendors, each presenting unique risks under Tennessee's regulatory framework.

- Assess vendors against specific requirements from the Department of Financial Institutions

- Streamline due diligence documentation for examinations

- Monitor vendor compliance with state regulations specific to Tennessee

- Generate examiner-ready reports with comprehensive vendor risk profiles

.png?width=750&height=560&name=4%20(1).png)

Ncomply

Navigate the regulatory landscape with tools designed to simplify compliance.

- Stay updated on specific regulations from the Department of Financial Institutions

- Maintain compliant policies aligned with state requirements

- Streamline examination preparation for Tennessee state examiners

- Automate compliance tasks in a single, centralized platform

.png?width=750&height=677&name=Products%20Page%20Graphics%20NComply%20(1).png)

Ncontinuity

Empower your financial institution with business continuity solutions designed for the unique challenges facing banks and credit unions specialized in your state.

- Address disaster scenarios including tornadoes and severe weather events

- Create continuity plans that satisfy Tennessee Department of Financial Institutions expectations

- Ensure seamless operations during regional disruptions affecting Tennessee's financial sector

- Enhance your institution's resilience with tailored recovery strategies

.png?width=750&height=683&name=Cyber%20Monitoring%20copy%20(1).png)

Nvendor Empowers Fahey Bank to Select the Best Vendors

and Stay on Top of Them

When Fahey Bank began serving customers in Marion, Ohio, in the 1800s, it shared an address with a grocery store. The current president can trace his lineage to the bank’s 19th-century founder, Timothy Fahey. A lot has changed since, but the bank still has its home office at the same location, although without the produce aisle.

With its storied history, Fahey Bank has learned to evolve with modern banking practices, especially when it comes to vendor management.

The Challenge

Fahey Bank faces challenges typical of many community banks. Its dedicated employees wear many hats and serve a variety of job functions. Christine Woodard serves as Vice President and Security Officer at Fahey. Vendor management is just a part of her job, which also includes disaster recovery and business continuity planning, physical security, enterprise risk assessments, and even jumping in on occasional IT work. Christine needed to save time and better manage vendor risk and enlisted Ncontracts for assistance.

The Solution

Nvendor has been a game-changer for Christine and her bank’s vendor relationship managers. From vendor selection to managing third-party risk throughout the vendor lifecycle, Ncontracts’ industry-leading third-party risk management (TPRM) solution has saved the bank countless hours and enabled Woodard to manage vendor risk more effectively.

“If I had to go back and do vendor management manually, it would take me at least twice as long to complete the same work and it would not be as accurate,” Woodard says.

The Results

Quicker, More Insightful Vendor Overviews: "Nvendor offers a seamless process for creating RFPs and identifying vendors that provide the necessary due diligence information."

Defined Workflows Based on Vendor Criticality: Christine can more accurately assess third-party risk during the selection phase, managing critical documents and conducting residual risk assessments based on vendor criticality.

Simplified Reporting: "Ncontracts' system allows me to take messy vendor reviews and risk assessments and transform them into beautiful executive summaries and board packs in minutes."

Less Tracking and More Action: "With the automated reminders in Nvendor, I don't need to track what vendors need annual due diligence. This feature alone is worth its weight in gold."

Improved Vendor Survey Response Rates: Nvendor enables personalized emails to vendors from her inbox, encouraging responses without appearing as phishing attempts.

Enhanced Collaboration: Christine easily collaborates with project managers, committees, and vendor relationship managers through streamlined workflows.

Objective Vendor Assessments: "I love the questionnaires in Nvendor. I don't want to make vendor assessments based on my opinion."

Quick Overview

Products: Nvendor

Results:

- Quicker, more insightful vendor overviews

- Defined workflows based on vendor criticality

- Simplified reporting

- Less tracking and more action

- Improved vendor survey response rate

- Improved collaboration

Start Your Success Story

Take control of your lending compliance process with Ncontracts' comprehensive solutions. Get a demo to see the CRA Analytics and Nlending in action.

More Case Studies

Fahey Bank Masters Risk Management

One Billion Credit Union Vendor Management