Optimize Risk & Compliance Management

Ncontracts empowers Georgia's banks and credit unions with integrated solutions designed for the Peach State's unique regulatory landscape.

On your personalized Ncontracts demo, you'll:

✓ See how to streamline vendor management and compliance processes specifically for institutions operating in the state

✓ Learn how our integrated platform helps you navigate regulatory requirements while strengthening risk monitoring capabilities

✓ Discuss your institution's specific challenges and compliance goals with the current regulatory framework.

Book a Demo with Ncontracts

Average Increase in Efficiency

with Ncontracts time-saving software & solutions

of the American Banker Top 200 Community Banks

trust Ncontracts for their risk, compliance, and engagement needs

Improved Risk & Compliance Culture

experienced among clients using the RPM suite

Designed For Compliance Challenges

Financial institutions across the Southeast face unique regulatory requirements from state banking departments and federal oversight agencies.

Our integrated risk management platform helps streamline compliance with both state-specific and federal requirements.

Banking Examination Excellence

State examination requirements include stringent vendor oversight documentation, business continuity testing, and third-party risk assessment protocols.

We help to simplify preparation, documentation, and response to these examination points while ensuring federal compliance standards are met.

Vendor Documentation

State vendor management documentation requirements demand thorough due diligence for technology providers and financial service vendors.

Our solution provides assessment templates, automated documentation tracking, and streamlined reporting that meets both state and federal examination expectations.

Consumer Protection Compliance

Consumer protection regulations include state-specific fair business practices acts and disclosure requirements that often exceed federal standards.

Our platform helps maintain compliance with unique state consumer lending requirements, disclosure mandates, and documentation retention policies across multiple jurisdictions.

Georgia Business Continuity

Regional business continuity requirements address local threat profiles including hurricane preparedness, flood mitigation, and cyber incident response specific to southeastern financial networks.

Ncontracts helps develop, test, and document continuity plans that satisfy both state examiners' expectations and federal guidelines.

Solutions for Financial Institutions

The Ncontracts risk performance management (RPM) suite is made up of

four software solutions specifically designed for the financial services industry.

Nrisk

The adaptive ERM platform tailored specifically for the Southeast's unique risk landscape. Designed to address complex regulatory requirements facing regional financial institutions, it transforms compliance complexity into a strategic advantage.

- Identify and assess risks specific to your state's financial environment

- Build controls aligned with state banking department expectations

- Generate state-specific regulatory reports with a single click

- Track emerging risks in your region's dynamic banking sector

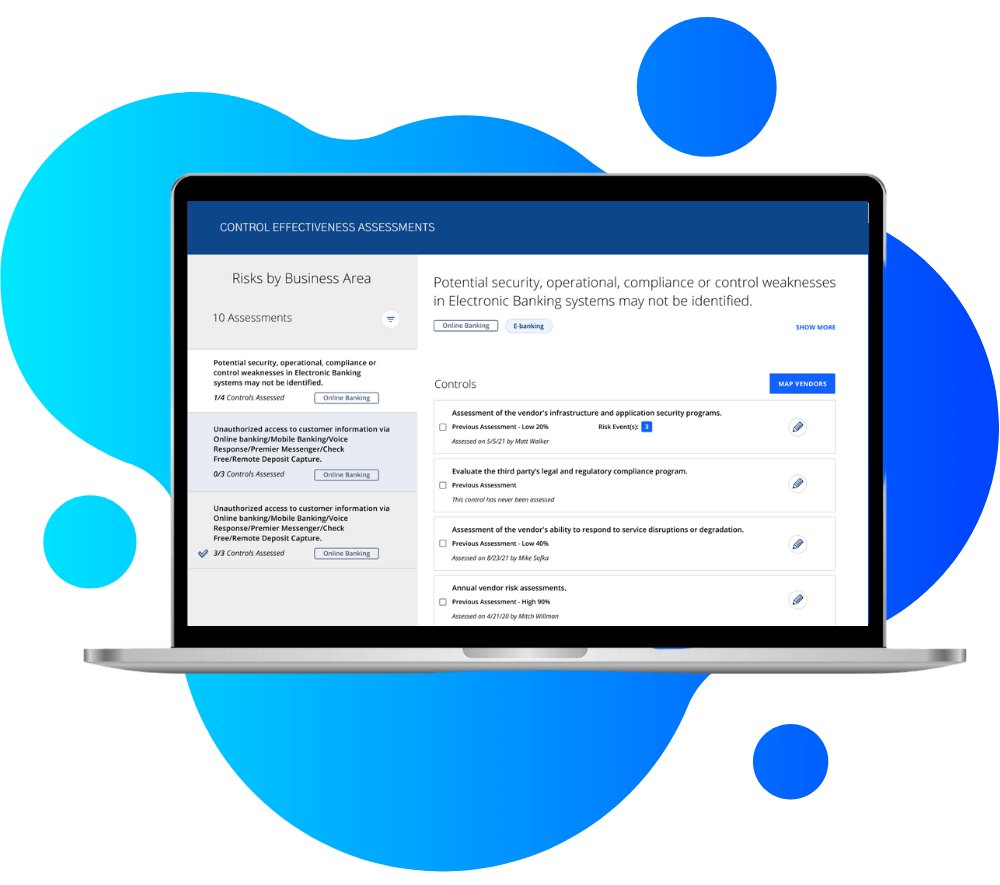

Nvendor

Financial institutions rely on dozens of third-party vendors, each presenting unique risks under state and federal regulatory frameworks.

- Assess vendors against state-specific requirements and federal guidelines

- Streamline due diligence documentation for all examinations

- Monitor vendor compliance with applicable state and federal regulations

- Generate examiner-ready reports with comprehensive vendor risk profiles

.png?width=750&height=560&name=4%20(1).png)

Ncomply

Endorsed by 150+ banks across the state for regulatory excellence

Navigate specific state regulatory landscapes while maintaining federal compliance with tools designed to simplify multi-jurisdictional requirements. Our compliance solution extends beyond individual states to support institutions operating across the Southeast region.

- Stay updated on both state-specific regulations and federal requirements

- Maintain compliant policies aligned with multiple regulatory frameworks

- Streamline examination preparation for state and federal examiners

- Automate compliance tasks across various regulatory jurisdictions

- Benefit from regional expertise covering multiple southeastern states

.png?width=750&height=677&name=Products%20Page%20Graphics%20NComply%20(1).png)

Ncontinuity

Empower your financial institution with business continuity solutions designed for the unique challenges facing banks and credit unions in your region.

- Address regional disaster scenarios including Atlantic hurricanes and severe weather events

- Create continuity plans that satisfy both state and federal examination expectations

- Ensure seamless operations during regional disruptions

- Enhance your institution's resilience with regionally-tailored recovery strategies

.png?width=750&height=683&name=Cyber%20Monitoring%20copy%20(1).png)

United Bank Case Study: Streamlining Third-Party Risk Management

United Bank Ensures TPRM Compliance with Nvendor

Founded in 1905, United Bank in Zebulon has deep roots in its small-town community and is committed to extraordinary service. As part of that mission, the bank works with third parties to offer all the technologies its customers expect.

Asset Size: $2.2 billion

Location: Zebulon, Georgia

Customer Since: 2023

Website: https://www.accessunited.com

United Bank needed a risk management solution that aligned with Georgia's interpretation of the regulatory requirements for third-party risk management released in 2023.

The Challenge United Bank needed a risk management solution that aligned with updated regulatory requirements for third-party risk management. The previous solution lacked financial institution focus and proved difficult to manage effectively.

The Solution United Bank adopted Nvendor, our industry-leading third-party risk management solution, with Professional Services and cyber monitoring. The bank later added Ntelligent Contracts Assistant (NCA), an AI-powered contract management tool.

"When we saw Nvendor and Ncontracts' focus on banking regulation we were excited. The products were built specifically to meet regulatory guidelines and ease the burden we face as banking professionals."

3 Tips for Implementation:

- Start small and gradually expand - Begin with vendors that matter most to regulators and represent your biggest risk

- Leverage professional services - Save time and ensure thorough reviews that meet specific requirements

- Use the tool to align with regulatory expectations - Demonstrate compliance and awareness of current guidance

The Results:

- Reduced vendor management workload for operations

- Enhanced efficiency aligned with regulatory expectations

- Alignment with current TPRM guidance

- More comprehensive reporting for examinations

- Improved cybersecurity posture

- Nuanced TPRM risk assessments

- Responsive product enhancements based on institution feedback

Quick Overview

Primary examiner: Federal

Reserve

Products: CRA Analytics (part of Nlending)

The Results:

- Save time and energy

- Improved data quality

- Easier CRA exams

- Deeper understanding of assessment areas

- More insight into merger activity

- New ways to identify marketing and sales opportunities

Start Your Success Story

Take control of your lending compliance process with Ncontracts' comprehensive solutions. Get a demo to see the CRA Analytics and Nlending in action.

View Our Other Case Studies

United Bank is just one of many financial institutions that have transformed their risk and compliance operations with Ncontracts.

From community banks to credit unions across the Southeast, our clients have achieved measurable improvements in efficiency, examination readiness, and regulatory confidence.

Explore our complete collection of case studies to see how institutions like yours have overcome compliance challenges and enhanced their risk posture with our integrated solutions.